Sydney startup Bountye lets users sell pre-loved items to their networks

FitTech is a crowded space and PT Essentials is focusing on the “business” side of the industry with its solution

The roots of the idea came about when Harris left his army career and went to study a personal training course. He told Startup Daily that during that period of time, everyone talking about all the problems they experienced in that industry, especially around managing clientele. Listening to that, he set out to proactively find a solution that would aid him in his soon-to-be career, and was unable to find something that ticked every one of the boxes in terms of functionality. Harris then decided to go out and create his own system.

BlueChilli came on board as a technology partner and investor in 2013. Last year, PT Essentials received the NSW Innovations Grant which gave the company $15,000 in matched funding capital alongside $15,000 from private investors, as well as a technology partnership / investment from BlueChilli. Last week, PT Essentials received an official AVOB (Australian Defence Force Veteran Owned Business) accreditation.

Harris is the first to admit that the company has had by 'startup' standards, an extremely long R&D and BETA process before launching its software to market. However, when speaking to him, it became quite understandable that his background in the army plays a significant role in having this mindset. He told Startup Daily that he wanted to focus on the build of the product first because "in the army you don't get second chances".

The startup has begun the switch from product development to sales, marketing and users. Currently, it has about 500 users who are all actively paying for one of a number of scaled packages to use the service.

"The industry is full of part time and full time trainers," says Harris. "A lot of people do personal training on the side and all of that so it was important for us to have packages that were for those as well as a full time operator. I don't really believe in free trials, I know when I do it myself I don't really value them accordingly so our [Kickstarter package is our version of a] free trial, which has been slightly monetised so that people use it and try it and give us feedback possible because that's the fastest way we're going to grow".

PT Essentials focuses on three main aspects / pain points that are important to those in the fitness space - CRM, OH&S and distribution. It allows the creation of exercise and workout databases, taking trainers' IP from inside their heads and building it into something more concrete and tangible such as work out schedules, specific workouts, etc. The platform allows for better client communication and lead generation, allowing trainers to market to as well as send clients RSVPs and reminders to help minimise no-shows. Perhaps most importantly, it allows users to scale their operations outside of just fitting in eight or nine clients a day. The platform allows trainers to create and send online programs and workouts to their own clients complete with instructions of exercises so that the hard work can continue when they are not personally training with them. This allows the trainers using the system to create an additional income stream for their business.

This particular part of PT Essentials concept has been proven to work, with trainers like Michelle Bridges, Commando Steve and Zac Smith among many others already employing this strategy in their own operations.

At the moment, trainers are only able to create workouts that are like 'explainer cards', but Harris says as the platform develops there are going to be all types of possibilities that arise out of that part of the business, such as being able to upload video workouts and other content related IP that users want to get in front of clients that could potentially be located anywhere in the world. The other feature that is important to note is the way PT Essentials delivers personal workout and achievement data to the user that can be passed onto their clients.

"In the gyms a lot of [workout data] is kept on paper and that's the best way of showing value to your client. It's one thing to get fitter or look better but a client doesn't actually value that or see your value as a trainer until you say 'this is why you got this way, and you got this way because of me'," says Harris.

"So you need to be able to show and demonstrate your value and being able to send your client a complete workout and progress report is how we think is the easiest way to do that. All of this is done through white labelling, so all these emails as well as any trainer to client communication shows that trainer's logo and other branded assets".

In terms of addressable market size for a product like PT Essentials, there is approximately 50,000 self-employed personal trainers operating businesses at any one time in Australia. The industry which is renowned for having an extremely high attrition rate, also has a high number of new graduates that enter the space each year. Once you begin to scale a solution like this outside of Australia and into international markets, there is at least 900,000 self employed personal trainers, according to Harris.

It's worth noting that PT Essentials has a lot of competition offering similar solutions. Companies like PT Manager Pro, PT Minder, PT Transact, Positive Flo, Mind Body and Fit Clients are all worthy adversaries with considerable traction and are also highly scalable startups themselves. As such, core things like the platform's UX, UI, pricing structure, brand awareness and the strategy of focusing on converting individual sole-traders, will begin to play a major role in PT Essentials being able to successfully launch into places like the United States, United Kingdom and even Asia.

Lyft raises further $150 million, bringing its valuation up to $2.5 billion

Image: Lyft CEO Logan Green. Credit: Fortune.com.

Bed Linen Heroes is leveraging licensing agreements with sports leagues to grow

The BedLinenHeroes product. Via bedlinenheroes.com[/caption]

And on those sales: since Bed Linen Heroes launched around Christmas last year, Darvell said sales have been “phenomenal.”

“It really took me by surprise, and it actually meant that I thought, oh this creates a different kind of problem to what so many of the other startups have, which is how to get sales. Mine was like how do I fulfil the sales? How do I pick and pack quick enough so we can get them out the door and make Christmas,” Darvell said.

“Because it was pre-Christmas, we were driving around in a truck delivering products to retailers and to customers to make sure we made Christmas. We made it happen but it was like jumping in the deepest end of the pool. But we learnt so much and I know every aspect of my business now, which is great.”

As well as through its online stores and various retailers, Bed Linen Heroes’ products are sold in NRL and A-league club stores online and at stadiums, with bigger department stores likely to come over the next few months.

Expansion is also on the mind for Darvell over the next twelve months or so. In addition to securing licensing agreements with other Australian sports leagues, Darvell is keen to launch into the UK and US sports markets. However, she is wary about doing it too quickly and is trying to learn from what happens in Australia.

“I've got the contacts already. Talks are happening, I know the right people. It’s now about finding the right time, and I guess the absence of me having investment means being clever about how to go about it,” she said.

A well-timed expansion offers a lot of opportunities: from the NFL to the NBA, NHL, and MLB, the US sports market is huge, and there don't seem to be any stores offering the same product.

But it’s not all about the stockists and spreadsheets - when asked if she had any other plans for the next few months, Darvell said, “to enjoy my business, because I’m loving what I’m doing.”

Darvell also wants to connect with women who want to start their own businesses; having had a child at 16, she wants to share her story about how she managed to kick start her career and launch her own business.

“I really want to get that message out to women, and be a bit of a champion for women out there who might be thinking about starting their own business.”

The BedLinenHeroes product. Via bedlinenheroes.com[/caption]

And on those sales: since Bed Linen Heroes launched around Christmas last year, Darvell said sales have been “phenomenal.”

“It really took me by surprise, and it actually meant that I thought, oh this creates a different kind of problem to what so many of the other startups have, which is how to get sales. Mine was like how do I fulfil the sales? How do I pick and pack quick enough so we can get them out the door and make Christmas,” Darvell said.

“Because it was pre-Christmas, we were driving around in a truck delivering products to retailers and to customers to make sure we made Christmas. We made it happen but it was like jumping in the deepest end of the pool. But we learnt so much and I know every aspect of my business now, which is great.”

As well as through its online stores and various retailers, Bed Linen Heroes’ products are sold in NRL and A-league club stores online and at stadiums, with bigger department stores likely to come over the next few months.

Expansion is also on the mind for Darvell over the next twelve months or so. In addition to securing licensing agreements with other Australian sports leagues, Darvell is keen to launch into the UK and US sports markets. However, she is wary about doing it too quickly and is trying to learn from what happens in Australia.

“I've got the contacts already. Talks are happening, I know the right people. It’s now about finding the right time, and I guess the absence of me having investment means being clever about how to go about it,” she said.

A well-timed expansion offers a lot of opportunities: from the NFL to the NBA, NHL, and MLB, the US sports market is huge, and there don't seem to be any stores offering the same product.

But it’s not all about the stockists and spreadsheets - when asked if she had any other plans for the next few months, Darvell said, “to enjoy my business, because I’m loving what I’m doing.”

Darvell also wants to connect with women who want to start their own businesses; having had a child at 16, she wants to share her story about how she managed to kick start her career and launch her own business.

“I really want to get that message out to women, and be a bit of a champion for women out there who might be thinking about starting their own business.”

Image: Tania Darvell with Malcolm Turnbull at Fishburners. Via Facebook.

New partnership between Rewardle and Air Asia gives us a glimpse into the startup’s future revenue strategy

How learning is changing across the globe

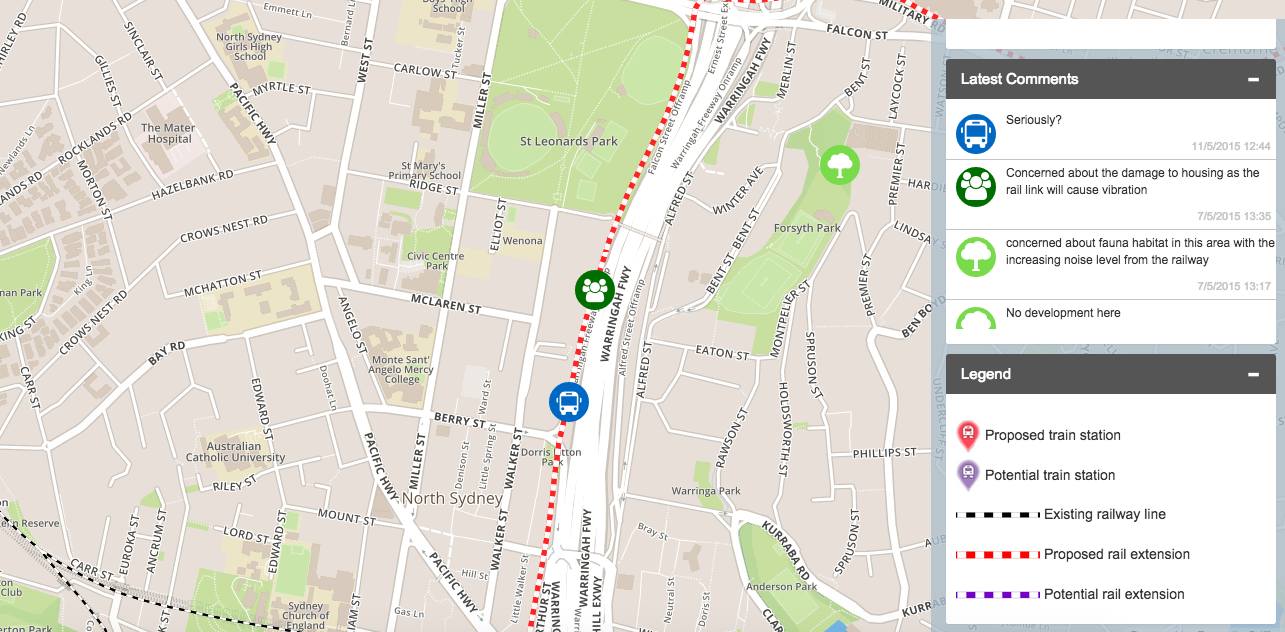

CommunityNotes wants to help councils and communities collaborate on developments

An example of a development on CommunityNotes[/caption]

The traditional community engagement process usually sees information about developments exhibited in Council offices, and discussions take place in community forums and meetings. Essentially, CommunityNotes brings these two processes together.

Ruppells Griffon will work with its council and developer clients to help them customise the app for specific development proposals. Residents will be able to access the app from any browser and add comments and feedback, as well as participate in conversations with other residents.

The project owners can then get access to real-time monitoring and analytics to see how the community is reacting.

Ouriques believes that the conversation aspect is one of the most significant features in the app.

“To date this level of transparency hasn’t been possible using the traditional community engagement model,” Ouriques said.

Though CommunityNotes provides a much-needed update to this model, there is the question of how to get residents to use the platform; after all, getting their feedback is the whole point. It must also be considered that older residents - who are often most interested in community developments - may not be internet users at all.

The app is available to councils and developers through a monthly subscription fee, meaning clients can pay to use the app only for specific projects, if needed.

With the app launched earlier this month at CeBIT, Ouriques said it has potential to be used in a range of industries including infrastructure, environment, utilities, and transport.

“There is huge potential for this to be used with companies that are in building and development. We have designed this app to be as broad as possible – it can be used by anyone that needs to get feedback from stakeholders on a land-based project,” she said.

Ruppells Griffon has also launched a free version of the app called YourSay, which lets users share information about their neighbourhoods, such as traffic alerts, crime news, and community issues.

Ouriques said, “YourSay uses the same underlying technology as CommunityNotes, making it the perfect platform for citizens that want to participate in making their neighbourhoods as safe and family-friendly as possible.”

“We’re expecting this to be the ‘gateway drug’ that pulls people over into the paid service when they need more control and customisation for specific projects.”

An example of a development on CommunityNotes[/caption]

The traditional community engagement process usually sees information about developments exhibited in Council offices, and discussions take place in community forums and meetings. Essentially, CommunityNotes brings these two processes together.

Ruppells Griffon will work with its council and developer clients to help them customise the app for specific development proposals. Residents will be able to access the app from any browser and add comments and feedback, as well as participate in conversations with other residents.

The project owners can then get access to real-time monitoring and analytics to see how the community is reacting.

Ouriques believes that the conversation aspect is one of the most significant features in the app.

“To date this level of transparency hasn’t been possible using the traditional community engagement model,” Ouriques said.

Though CommunityNotes provides a much-needed update to this model, there is the question of how to get residents to use the platform; after all, getting their feedback is the whole point. It must also be considered that older residents - who are often most interested in community developments - may not be internet users at all.

The app is available to councils and developers through a monthly subscription fee, meaning clients can pay to use the app only for specific projects, if needed.

With the app launched earlier this month at CeBIT, Ouriques said it has potential to be used in a range of industries including infrastructure, environment, utilities, and transport.

“There is huge potential for this to be used with companies that are in building and development. We have designed this app to be as broad as possible – it can be used by anyone that needs to get feedback from stakeholders on a land-based project,” she said.

Ruppells Griffon has also launched a free version of the app called YourSay, which lets users share information about their neighbourhoods, such as traffic alerts, crime news, and community issues.

Ouriques said, “YourSay uses the same underlying technology as CommunityNotes, making it the perfect platform for citizens that want to participate in making their neighbourhoods as safe and family-friendly as possible.”

“We’re expecting this to be the ‘gateway drug’ that pulls people over into the paid service when they need more control and customisation for specific projects.”

HR startup Weirdly is helping companies find their perfect “weirdos”

"We assist in that step based on what you as a company are looking for. So you determine what attributes, character and personalities you're looking for and then Weirdly's algorithm uses those as a baseline upon which it measures everyone else," said Phillips.

The platform takes the attributes that users outline and build into quiz questions, then measures how well candidates are at displaying those attributes in their answers to the questions. Ultimately, it gives the user numerical insights as to whether someone fits into their business. For example, it would say something like 'X fits into your business 20% and Y fits into your business 87%'.

Although Weirdly is focused on growing via sales, the team did take on some seed funding invested by the Punakaiki Fund, a firm that invests in early stage New Zealand startups, to help them move from having a beta product into creating a fully formed and scalable piece of software. Although it is not immediately on the cards, Phillips told Startup Daily that at some point in the future a Series A round may be pursued as they begin to focus on the next wave of scaling the company.Weirdly has had a global focus from day one and has managed to attract clients not just locally in New Zealand but across Australia, the United States and Europe, a lot of this expansion has been the result of getting in front of the New Zealand branches of international companies. Brands like Xero, Jucy Rentals, Vend, Allianz and Spark (NZ Telco) are all using the platform now as part of their recruitment processes.

There are two revenue models in the way Weirdly is structured. The first is targeted at bigger enterprise level companies that have robust recruitment processes in place.

"They have people driving those systems who are very very good at what they do, so they're working with in house or external recruiters, so they really know what they're doing right," said Phillips. "The way that we work with them is by a plugging into their existing processes and helping them filter the applicants that they have coming into jobs against cultural measures. They all have systems that are really good for filtering people against hard skill measures, like when you went to university and what job you did last time and all of those kind of metrics."

What Weirdly gives those clients is the components that are cultural fitters. At the other end of the scale, the platform also provides a self-service product for people to buy off the shelf via subscription in the same way that you would any other SaaS product like Xero. This product lets users set up the quiz themselves and integrate with their own platforms including job boards and social media pages.

"The whole premise is around helping these smaller sized operations, who are time poor and often not as experienced in recruitment build a better quality candidate shortlist faster," said Phillips.

Lodgify just raised €600,000 in seed funding. What made Australian investors support this European startup?

CapitalPitch is a new equity investment platform for startups looking to raise a Series A, but it also has an education element

Image credit: Business Insider.

How to hire an intern without breaking the law

- Purpose of the arrangement: Was it to provide work experience to the person or was it to get the person to do work to assist with the business outputs and productivity?

- Length of time: Generally, the longer the period of placement, the more likely the person is an employee

- The person’s obligations in the workplace: Although the person may do some productive activities during a placement, they are less likely to be considered an employee if there is no expectation or requirement of productivity in the workplace

- Who benefits from the arrangement? The main benefit of a genuine work placement or internship should flow to the person doing the placement. If a business is gaining a significant benefit as a result of engaging the person, this may indicate an employment relationship has been formed. Unpaid work experience programs are less likely to involve employment if they are primarily observational

- Was the placement entered into through a university or vocational training organisation program? If so, then it is unlikely that an employment relationship exists.

Redbubble raises $15.5 million in latest oversubscribed funding round

Sydney’s latest tech event Daze of Disruption was not my kind of circus, but it highlighted a bigger industry problem

featured image: Daze of Disruption Conference | Credit: B&T Magazine

Recent study by Intuit indicates Australian startups need to know their numbers better

Startup Winephoria wants to make choosing wine fun by matching wine to your personality

Qwilr’s innovative platform may just bring an end to one of biggest problems in the enterprise space

From co-founder to ousted CEO of 500px: Trials, errors, and lessons learned

image source: Business Financial Post

Rocket Internet-backed Spotcap launches in Australia, offering SMBs microloans

Image: Spotcap co-founder Toby Triebel.

Sydney startup Prize Pig is making it easier for small businesses to connect with large media players

Although the business only launched about eight weeks ago, already the platform has just over 110 subscribers and a healthy growing amount of media outlets on board. Of course, building a two-sided marketplace comes with many challenges - including overcoming the chicken and egg conundrum. According to Westphal, the key will be to have as many prize providers as possible. She believes this is what will attract more media companies to use the platform. The other challenge is competition. Essentially Prize Pig is taking on a similar, yet automated, functionality that has usually been fulfilled by PR Agencies that do media give-aways as a secondary service for their clients.

Westphal says that while they may be competitors, public relations and promotions firms actually represent a significant opportunity for the startup.

"If there was ever a really big opportunity for us; it's PR agencies. I was working with Free Publicity prior to starting this business and doing all of their competitions. However, when I left [to start this venture], they started to run all of their competitions through Prize Pig. So they've saved on my wage and pay a small fee on The Pig," says Westphal.

Targeting these types of firms will therefore be a focus for the startup over the next 12 months.

"I would like to partner with many more agencies and I'd like to triple my number of prize providers," she says. "I'd also like exclusivity with every single media outlet in the country. My goal is to be the only place they're going to for prizes."

Featured image: Founder, Prize Pig, Amanda Westphal | Source: Supplied

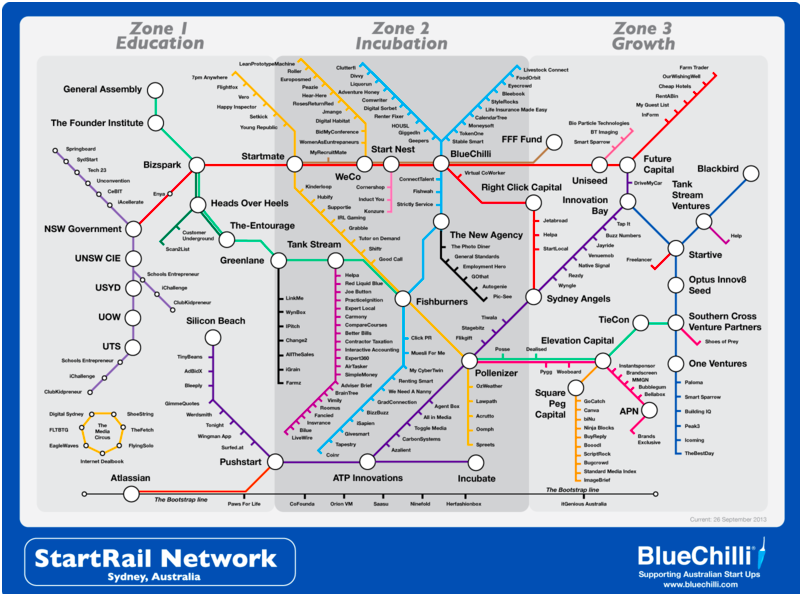

BlueChilli to produce interactive StartRail maps for each of Australia’s startup regions

BlueChilli's CEO Sebastien Eckersley-Maslin originally came up with the idea for the StartTrail map, based on Sydney's CityRail map, as a task for a graphic design intern. The first map was Sydney-only and divided into three zones: education, incubation, and growth, with organisations like incubators, accelerators, and VCs appearing as stations.

[caption id="attachment_41230" align="alignnone" width="800"] startrail2015.com[/caption]

startrail2015.com[/caption]

With the map was last revised in 2013, BlueChilli's Alan Jones said the company has been overwhelmed by the growth in the tech startup sector over the last few years.

“The growth in the Australian startup ecosystem and its outward spread from Sydney and Melbourne into capitals and regional areas across Australia has been enormous,” Jones said.

The company will this year produce a StartRail map for each startup city, region, or community that has ten or more startups completing the survey.

With the startup ecosystem at large booming, the idea of mapping it out has emerged as a useful way to keep track of the different parties and stakeholders involved. Paul Daly, convenor of the Adelaide Entrepreneurship Forum, produced a map showcasing the Adelaide startup ecosystem, while StartupBlink took on the task of creating a global map last year.

You can complete the StartRail survey here.