Sydney startup FraudSec is a whistleblowing platform that guarantees anonymity

Opposition Leader Bill Shorten announces $4.5 million funding program to help get girls into coding

Red Carpet wants to allow users to connect with celebrities in the name of a good cause

Melbourne startup Real First Aid teaches first aid through stressful real-life simulations tailored to specific industries

With an additional $3 million in seed funding Redzy is shaping up to be one of Australia’s more successful TravelTech platforms

Tech and internet industries dominate this year’s BRW Young Rich List

Victorian government lures SydStart to Melbourne with $1 million in funding, event to rebrand as StartCon

Image: Sean Ellis speaking at SydStart yesterday. Source: SydStart.

Slingshot and HCF partner to launch health tech-focused accelerator program

Like other corporate-supported accelerators, such as Slingshot's NRMA Jumpstart accelerator, the association with HCF means that participants could have a ready-built market waiting for their product. HCF is Australia's largest non-profit health insurer, covering 1.5 million Australians.

Sheena Jack, HCF's chief strategy officer, said the organisation is delighted to partner with Slingshot on this initiative.

“HCF has a longstanding reputation as an innovator amongst Australian health insurers, so it is only fitting that we create new ways to nurture the people and ideas that will drive the next wave of health tech innovation,” Jack said.

Slingshot founder Craig Lambert said that the opportunity to work with HCF's customer base will be "invaluable" for the chosen startups.

“The health industry is extremely innovative by nature, but this program marks the first time a major corporation has made this type of long-term commitment to nurturing startup innovation in the health tech space,” he said. ‘The accelerator will focus on ideas that impact the health sector in different ways, from improve access to information and the use of data analytics to preventative care and decreasing health care costs. We see so much potential for startups in this sector and we’re thrilled to be partnering with HCF to give entrepreneurs an opportunity to make a real impact in Australia’s health industry.”The Catalyst accelerator will also include a 'scaleup' program, to help more established startups in the field gain access to a larger audience.

One can expect that the program will run much like Slingshot's Jumpstart program, which has just wrapped up its second intake and also included a scaleup program. The potential benefits in a corporate-backed program are huge for both the corporate and the startups participating - NRMA President Kyle Loades has called the Jumpstart program a "logical extension of our ongoing quest to develop and offer new products and services to our members."

The news comes after Australia Post announced its new innovation partnership with the Melbourne Accelerator Program at Melbourne University, worth $1 million over three years. The partnership will see two extra spots created in the Program, as well as a scholarship to the Wade Institute of Entrepreneurship.

Startups interested in applying to HCF Catalyst can learn more here.

Image: Slingshot's Craig Lambert. Source: Supplied.

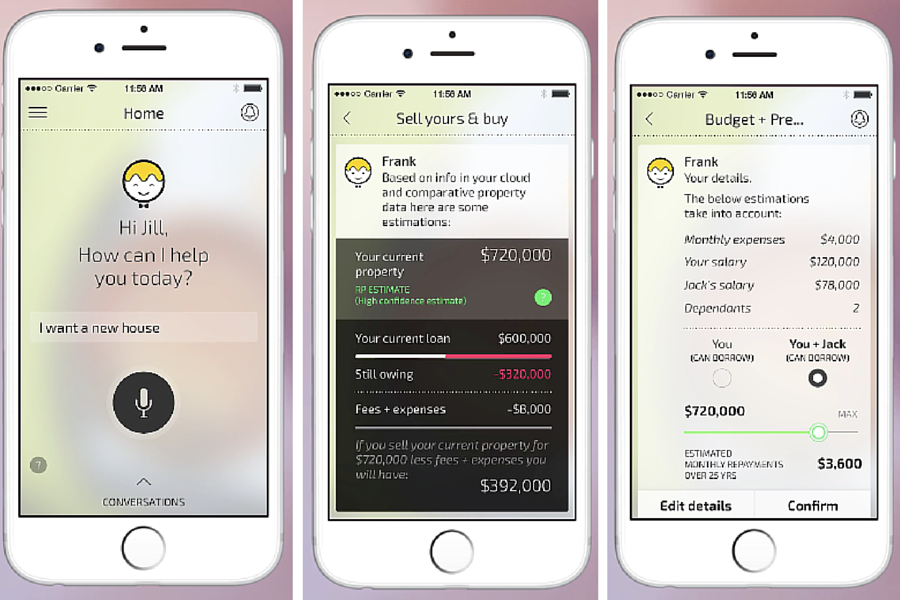

New Zealand startup MyWave’s intelligent assistant allows users to better manage data shared with brands

mywave.me[/caption]

Though Frank can be licensed for specific services and brands - MyWave’s first announced client is Saveawatt, a New Zealand company that is using Frank to help customers manage their power usage - McBride said MyWave is an open platform which any product or service can be a part of.

With Gartner Group estimating that more than USD$2 billion of online shopping will be done by mobile personal assistants by 2016, the opportunity here is huge. However, McBride said one of the biggest challenges faced in the building of MyWave was simply communicating the product vision to both prospective customers and investors.

“People understood only when we were able to build and demonstrate MyWave use cases which showed Frank in action doing stuff such as finding and buying a home, managing household accounts, and small but valuable things such as finding and buying a new mountain bike or a pair of shoes. Our mantra is ‘show not tell’. Once people see Frank in action they get it and want it.”

Despite the difficulties getting the vision across at first, MyWave has raised two rounds of funding, a Series A round of NZD$2.5 million in May last year, and a Series B round of NZD$4.5 million in early October that has valued the startup at NZD$50 million.

With the startup having recently launched in the US and hired former eBay director Wally Brill as US vice president, McBride said the funding will help spur its international growth, with the launch of its UK subsidiary planned for December. It will also help the startup double the size of its Melbourne software hub.

The startup is talking with major brands around the world, who McBride said love having a direct way to work with consumers.

“We have a flexible partnership model which will see us partnering with consulting firms specialising in the emerging Intelligent Assistant market, as well as directly with large global brands. We have a strong lead in the Intelligent Assistant market with more than 2.5 years intensive software development behind us, and the first live customers,” McBride said.

“My goal is to keep building market momentum at a rapid pace. Intelligent Assistants will change the way the world uses smart devices, they will replace the browser and search as we know it. We can see that change happening much faster and in a much more disruptive way than most people realise.”

mywave.me[/caption]

Though Frank can be licensed for specific services and brands - MyWave’s first announced client is Saveawatt, a New Zealand company that is using Frank to help customers manage their power usage - McBride said MyWave is an open platform which any product or service can be a part of.

With Gartner Group estimating that more than USD$2 billion of online shopping will be done by mobile personal assistants by 2016, the opportunity here is huge. However, McBride said one of the biggest challenges faced in the building of MyWave was simply communicating the product vision to both prospective customers and investors.

“People understood only when we were able to build and demonstrate MyWave use cases which showed Frank in action doing stuff such as finding and buying a home, managing household accounts, and small but valuable things such as finding and buying a new mountain bike or a pair of shoes. Our mantra is ‘show not tell’. Once people see Frank in action they get it and want it.”

Despite the difficulties getting the vision across at first, MyWave has raised two rounds of funding, a Series A round of NZD$2.5 million in May last year, and a Series B round of NZD$4.5 million in early October that has valued the startup at NZD$50 million.

With the startup having recently launched in the US and hired former eBay director Wally Brill as US vice president, McBride said the funding will help spur its international growth, with the launch of its UK subsidiary planned for December. It will also help the startup double the size of its Melbourne software hub.

The startup is talking with major brands around the world, who McBride said love having a direct way to work with consumers.

“We have a flexible partnership model which will see us partnering with consulting firms specialising in the emerging Intelligent Assistant market, as well as directly with large global brands. We have a strong lead in the Intelligent Assistant market with more than 2.5 years intensive software development behind us, and the first live customers,” McBride said.

“My goal is to keep building market momentum at a rapid pace. Intelligent Assistants will change the way the world uses smart devices, they will replace the browser and search as we know it. We can see that change happening much faster and in a much more disruptive way than most people realise.”

Australian Prime Minister’s Office partners with Pollenizer to launch DataStart incubator initiative

Sydney FoodTech startup HowAboutEat wants to stop office workers from skipping lunch

NAB to hold FinTech-focused hackathon at Sydney coworking space Fishburners

Image: Jon Davey of NAB Labs and Fishburners' Murray Hurps with Fishburners members. Source: Supplied.

Three $200 million Aussie funds have launched so far this year. Is this a welcome change in the weather for startups?

Blackbird has a strong portfolio, having invested in well-regarded companies like Canva, LIFX, Shoes of Prey, Bugcrowd, CultureAmp, SafetyCulture, Autopilot, and Elto (acquired by GoDaddy), among others. Its first fund has invested in 20 companies, and another 21 through its startup accelerator Startmate. Blackbird Ventures says it will continue to invest in 10 new startups per year, however the new funds will allow it to continue supporting companies through the later stages of their lifecycle, meaning portfolio companies will be able to more easily raise post-seed growth rounds like Series A and B.

And now there is Square Peg Capital. With its latest $200 million fund, it will be putting dollars into both local and international startups. According to a statement given to the Australian Financial Review, the fund will aim to identify and invest in the next SEEK, carsales.com or Atlassian. Current investments in the Square Peg Portfolio include Australian tech startup companies like GoCatch, Rokt, Vend, and ScriptRock. On the growing local competition in the venture capital space, Square Peg Capital cofounder Justin Liberman told AFR that because of the nature of what VC firms do, they are actually competing as much with global funds as they are with local funds like Blackbird and Brandon. "We see Accel as much as a competitor as Blackbird, frankly; they have made six investments in Australia including Atlassian and 99designs, so these days it doesn't matter whether you are in Singapore, Shanghai, Sydney or South Yarra," he said. It is not just venture capital funds increasing funding There is also a noticeable change in the accelerator space when it comes to an increase in funding for startups. Sydney-based startup accelerator Startmate, which has one of the highest startup success rates, announced recently that it will invest up to $150,000 into its next batch of startups. It has also partnered with creative agency Droga5 to help 2016 participants with storytelling, a struggle for many founders with promising products. Likewise, Telstra-backed muru-D has increased investment into its startups to $80,000 and announced a new independent follow-on venture fund run by a number of its mentors. Named Bardama, the fund is to be managed by an advisory board comprised of Andrey Shirben of Syd Ventures, angel investor Angela Kwan, Rob Castaneda of Service Rocket, Carl Hartman of Temando, and Andrew Coppin. Its aim now is to facilitate $200,000 of investment through the program and networks. $80,000 for 8 percent, with $120,000 as a follow-on. In addition to the funding, muru-D also recently announced two big partnerships, linking up with Shanghai’s Chinaccelerator and the 500 Startups accelerator in Silicon Valley to provide its participants with a clearer path to the Chinese and North American markets and easier access to capital. The agreements will see muru-D companies be able to pitch directly to the organisations for early investment, have their applications to both accelerators fast-tracked, and connect with US and China-based startups, investors, and mentors, and potential customers. In Melbourne, the AngelCube accelerator also increased its funding this year from $20,000 per startup to $40,000 per startup. Cofounder Nathan Sampimon said at the time the move was a reaction to the Australian startup ecosystem starting to mature. We are definitely maturing Particularly since the change in federal leadership this year, there is definitely a perception of the Australian startup ecosystem maturing at a much more rapid pace than usual. For the first time, innovation, coding education, and technology investment are mainstream discussions in both the Liberal and Labor party camps. Stakeholder sentiment across the startup space has quite obviously shifted and government departments are proactively partnering with the private sector now with events like PolicyHack, DataStart and the newly rebranded StartCon, putting funds and resources into the sector instead of just talking about it. A critical area that has always needed improvement in Australia is a more supportive regulatory environment to enable startups to ‘get on with the job’ and build businesses with a global reach that contribute to the city, state, and federal economies in a positive way. Making things like equity crowdfunding and crowdlending accessible to Australians without so many conditions is an example of what I am talking about here; countries like the UK and New Zealand have seen a lot of positive traction by implementing supportive legislation around these two things. We are now starting to see serious in-depth discussions happening around these topics. We are growing up, we are maturing as an ecosystem and government support is allowing that to happen a lot more rapidly than previous years. As this support continues we will see more access to money, talent and, of course, infrastructure that will encourage innovation, creativity, and ideas. It will change the way the Australian startup ecosystem is viewed on the global stage.Invoice2go raises $15 million as it launches a new mobile payments feature powered by Stripe

"They wanted to make a larger investment in the company," says Strode. "We’ve laid a lot of groundwork over the past year and this new round of funding gives us the right amount to help us turbocharge our efforts and accomplish what we are now perfectly positioned to do."

Micky Malka, founder of Ribbit Capital, echoed the sentiment, stating that, “Businesses are interacting more and more through Invoice2go and we’ve been thrilled to be a part of it over the last year. We’ve now significantly increased our ownership through [this] Series C financing to further support what we believe is one of the most exciting financial software companies today."

In conjunction with the announcement, the company also announced that is has introduced a new mobile payments feature that will allow small businesses and freelancers to accept credit and debit card payments from customers in order to get paid faster. This feature will be powered by Stripe Connect, one of the startup's new partners. The new feature is unique because it integrates the entire billing process seamlessly into one app, a game-changer for every small business owner who has spent countless hours manually invoicing, collecting payment, and reconciling their accounts to keep on top of their cashflow. This new feature will roll out across Australia in 2016."I think one of the most powerful things about the feature for me is how simple it is," says Strode. "It means that literally with one click, businesses will be able to immediately offer more payment options to their customers, straight through the invoice. No more waiting around or filling out endless paperwork to open a merchant account. Having been a small business owner, I know first hand how painful that process really is."

"Also, it helps small businesses get paid quicker. We’ve always been focused on helping people get paid, so the fact that our customers no longer need to wait for a check in the mail is really exciting. Giving people easier ways to pay on the spot means businesses will see that money deposited in their bank account faster." Strode is excited about the next stage of growth for his business, especially at the prospect of being able to leverage his solid base of customers that use the product now on a daily basis. He said, "We’ve now raised a significant amount of money, have a strong base of customers who use our product every day, and have the right team in place to aggressively deliver new features and products for small businesses everywhere."Brisbane startup Daily Crow News is another startup looking to take on the tough media space

Melbourne FinTech startup MoneyPlace launches offering consumers up to $35,000 in peer-to-peer loans

Stoyan said the platform aims to provide fairer rates for borrowers.

"For too long Australian borrowers have been penalised by the big banks, with their ‘one size fits all’ approach to personal loans at 15 per cent and credit cards at 20 per cent. At the same time they are penalising people for simply saving their money, even this month keeping deposit rates flat while raising mortgage rates, all ahead of announcing $30 billion in profit," Stoyan said.

Once the platform has fully launched, a user interested in getting a loan will be able to simply detail how much they want to borrow, the duration of the loan, whether they would classify their credit as excellent, average, or poor, and select what the loan is for, whether it's for a new car, home improvement, and so on.

Though it took "considerable time and effort" to gain regulatory approval from ASIC, Stoyan said it was encouraging to see the ASIC's willingness to understand the MoneyPlace model and ensure it is properly regulated.

“This demonstrates ASIC's readiness to work with startups and foster innovation in financial services while ensuring it protects the consumer.”

Rob Coombe, group CEO at Quick Service Restaurant Holdings, and Marcus Oakley, a former chief risk officer for GE Capital Consumer Finance, have joined the startup's advisory board.

MoneyPlace is just the latest in a line of lending startups to launch or do big things this year. Most, however, have focused on lending to startups and small businesses.

Rocket Internet-backed Spotcap launched its Australian arm earlier this year, offering SMBs credit lines that make available to them amounts varying from $1,000 up to $100,000, from which they can then draw a loan. Startups apply for a credit line by providing Spotcap access to their cloud accounting software or their ecommerce store, for example, after which Spotcap’s algorithm will determine whether the business has been approved for a credit line and its terms. Melbourne startup Moula, which uses similar data to provide short-term capital of up to $100,000, closed a $30 million funding round in June.

MoneyPlace's direct competitor as a peer-to-peer lender is SocietyOne, a startup founded in 2011 that counts James Packer and Rupert Murdoch among its investors. SocietyOne is the only other peer-to-peer lender to have attained a full licence from ASIC. Its last round of funding came in December last year, raising USD$21.13 million in a Series B round.

As it currently stands, MoneyPlace is letting borrowers and wholesale investors register their interest on the site. Once loan volume allows, the platform will also open to retail investors.

Restaurant booking platform Dimmi partners with iVvy to help restaurants manage private function spaces

Image: Lauren Hall and Stevan Premutico.

1 in 4 Australians have been discriminated against at work on the basis of gender

Melbourne startup Point & Claim has developed advanced optical character recognition technology to make tax time easier

Image: Simon Bishop. Source: Supplied.

Dropbox announces its new Enterprise product with frictionless scalability for IT departments and data-driven insights