myPresences want to be the ultimate small business platform but there will be some challenges ahead

Fishburners’ selective application process has allowed it to become one of Sydney’s premium startup hubs

Uber & Airbnb: the challenges in two-sided markets

This Sunday, parody social media accounts will be illegal in China

According to regulations, all Internet users account name on the Internet Information Services for registration subject to the nine rules, including not violate the Constitution and laws; not endanger national security, leaking state secrets, subverting state power, undermining national unity; not incite ethnic hatred ethnic discrimination, undermining national unity; not spreading obscenity, pornography, gambling, violence, murder and other content. Any violation, the account will be imposed a suspended until logout. National Network Information Office deputy 任彭波 [Peng Bo] said that a goal of the remediation action is " to see the name of someone on the Internet, it is not disgusting, not chaos, is comfortable "to make cyberspace more cool and bright.Basically under the new rules the following types of usernames would be banned, as explained by TechinAsia.

- Usernames impersonating or satirising public figures (no more usernames with “Obama” or “Putin” in them, for example)

- Usernames that harm national security, reveal state secrets, subvert government authority, or harm national unity.

- Usernames that incite ethnic/racial hatred, discriminate against an ethnicity, or harm national ethnic unity

- Usernames that promote/disseminate vulgarity, pornography, gambling, violence, or assassination.

SpaceWays is the latest Rocket Internet startup to launch into the Australian market

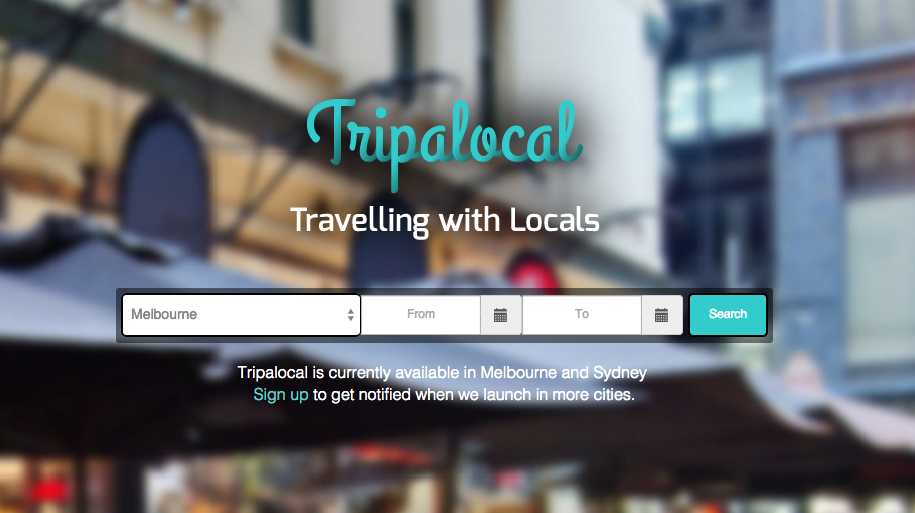

Strategic decisions around its advisory board allowed Tripalocal to gain unprecedented advantage in China

Screenshot of Tripalocal English version of the site[/caption]

[caption id="attachment_38329" align="aligncenter" width="543"]

Screenshot of Tripalocal English version of the site[/caption]

[caption id="attachment_38329" align="aligncenter" width="543"] Screenshot of Tripalocal Chinese version of the site[/caption]

Screenshot of Tripalocal Chinese version of the site[/caption]

This does not necessarily mean that once users arrive in Australia and engage the experience they have purchased, that they expect the suppliers of those experiences to also speak perfect Mandarin. In fact Xu says that the vast majority of customers to date prefer that the suppliers only speak in English, mostly because it makes the experience much more authentic.

"So far we have found that the travellers who have come to our platform are quite comfortable speaking conversational english, and sometimes they actually prefer a host [our suppliers of experiences] do not speak Chinese as it makes it a more authentic experience, and is a good way for them to practice their english," says Xu.

"But having said that there are also those who prefer the hosts who actually speak Chinese, so for our platform, we have both, both bilingual ones and also just english speaking ones."

This bilingual feature is one of the core components that was missing from startups like Arribaa that launched in 2013 with a similar concept of allowing travellers to have genuine experiences with passionate locals. When Arribaa launched, the idea sounded solid - the startup raised funding, and the site experienced some uplift in the beginning. In hindsight, perhaps the thing that led to the startup's eventual demise was the lack of a niche focus around building a 'traveller pipeline'. Tripalocal has managed to implement both of these things as core features. The niche focus is obviously outbound Chinese travellers; and the startup is using two very calculated marketing strategies to keep a pipeline of interested users travelling through. It is the travellers that are the key in this startup succeeding, as suppliers will naturally flock to a platform where money can be made, as those with the wallets begin to scale. Xu told Startup Daily and also mentioned in her Chinese Investor Night presentation at muru-D, that Tripalocal had formed some strategic partnerships and affiliate arrangements with online travel platforms in China, which has put the startup in front of some quite substantial databases full of potential customers. The other marketing strategy that Xu says the startup is seeing significant traction from is the Chinese based application WeChat backed by Chinese ISP Tencent, Inc. The app has recently introduced business profiles; and users are able to follow and engage with those companies. To give you some insight into the power that this particular social media company is wielding right now, in China, CCTV recently utilised WeChat during its New Years Eve Gala that was broadcasted on the network. Aside from the fact that even in its 32nd year it happens to be one of the most watched television shows on the planet (even though it had a record low of around 700 million viewers this year), the combination of the television channel and WeChat giving away $80 million in prize money on the night produced some mind blowing social media statistics. Users had to shake their smartphones at the television set to have a chance at winning the prize money; and Chinese viewers did this over 11 billion times that night. Whilst Xu is under no illusion that Tripalocal is not in a financial position to run that kind of campaign on the WeChat platform, she told Startup Daily that it is driving users organically, and expects it to continue to grow as the brand gains more followers. So how exactly is the Tripalocal team gaining so much traction in the Chinese market at such an early stage? If you think that the answer is the team had connections already in place, you would be mistaken. Xu says that prior to joining muru-D, she had zero connections in the Chinese market. The only advantage she and her team had was that they can speak the language. Xu says that her biggest help came from the mentors within the muru-D program, and that when the teams were tasked with finding additional investors to go in at the same valuation as Telstra (muru-D) was, she picked up the phone and called venture capital firms and investors based in China. As a result of that Tripalocal has a strong advisory board with three strong female advisors that also happen to be based in China. Fan Wang is the Director of Strategic Investments at Trends Media Group, Xinhua Zhou is a partner at HGI FINAVES China Fund and Tina Ni is the Investment Director at Shanghai NCE Ventures. Attaching these names as well as the others that sit on the Tripalocal advisory board meant that when Xu went on her first trip to China at the start of the year, she already had 20 to 30 meetings lined up with various investors and potential partners and it has continued to have a snowball effect with "so many doors opening" for the startup within the Chinese market. Tripalocal is currently in the middle of closing its first major round of funding. Althought Xu was quiet on the specifics, she did mention that it would be somewhere in the vicinity of US$500,000 and $1 million. Xu is currently talking with many VC firms in China about this and it is highly likely that she will also be looking towards Australia for investor interest as well.Startup Daily has formally partnered with Muru-D over the next 12 months to bring you the stories of its startups, mentors and investors.

Dating startup SparkStarter lets friends play Cupid online

After only 18 months in business Frank Body will likely exceed $20 million in revenue this year

Frank Body has incredibly on point branding.[/caption]

The Frank team has also recently started to add new products to the mix outside of the body scrub line, launching a new body balm product last year. With such strong branding and packaging teamed with an impeccable UI and UX on the website, it is no wonder that the company is turning into the beauty and cosmetics juggernaut that it is.

Frank Body products are manufactured in Melbourne and sold exclusively via their online store - a clever move considering their customer base is rapidly growing across the United States, Canada, Europe and the United Kingdom. In fact these markets are rapidly catching up to its original and largest market, Australia.

Frank Body has incredibly on point branding.[/caption]

The Frank team has also recently started to add new products to the mix outside of the body scrub line, launching a new body balm product last year. With such strong branding and packaging teamed with an impeccable UI and UX on the website, it is no wonder that the company is turning into the beauty and cosmetics juggernaut that it is.

Frank Body products are manufactured in Melbourne and sold exclusively via their online store - a clever move considering their customer base is rapidly growing across the United States, Canada, Europe and the United Kingdom. In fact these markets are rapidly catching up to its original and largest market, Australia.

Growth of SolarQuotes shows there’s a market for environmental startups in Australia

Scutify raised two rounds in 2014 totalling $1.5 million but we never heard anything about it

People shouldn’t mistake startup Ureferjobs as another job hunting platform

Forbes.com writer Jason Lim launches Asia Recon, an initiative exposing Aussies to hidden opportunities across Asia

"Asia Recon is a tour for Australian tech leaders to three of Asia’s most exciting tech hubs: Singapore, Shanghai and Beijing. Like a real reconnaissance mission, the goal is to take the best representatives from Australia, to visit Asia and bring back new insights, ideas and relationships for the future benefit of Australia," said Lim.

"More importantly, they will meet local high profile entrepreneurs, investors, accelerator managers and their advisors who will share deep experience and insight about doing business in Asia".

Partners that have already confirmed to be part of the tour include Innovation Works, the most prestigious incubator in China, App Annie (raised $55 million in January), Blk 47 (backed by Singapore government), and a US$500 million investment fund.

The idea for this tour came about after Lim returned home to Sydney last year and gave some presentations about China's tech startup ecosystem at places like Fishburners and BlueChilli. After seeing the strong sense of curiosity about Asia and realising there was a deep knowledge gap about it, particularly from an Australian perspective, Lim decided to do something to bridge that gap so Australian startups would become aware of the abundance of opportunities awaiting them across Asia.

"As an indicator of size, in terms of venture capital funds invested in 2013, there was US$3.46 Billion into Chinese startups, US$1.71 Billion into Singaporean startups and just US$490 Million into Australian startups. China’s largest tech company is worth well over US$100 Billion and Australia’s is less than US$10 Billion" said Lim.

"With the recently signed Free Trade Agreement with China as well as Australia’s mining slowdown, it is now a perfect time for Australian entrepreneurs, investors and their advisors to take full advantage of the tech boom in the region. With deep capital, human talent, and market size, Asia offers amazing opportunities".

If all goes well, Asia Recon will expand its tour offering to Taiwan, Hong Kong, Japan, Korea and India as well as other emerging tech hubs in Asia over the next 12 months.

Applications are now open for interested entrepreneurs, investors and corporates that are interested in taking part in the event until March 30th here.Startup InvoiceBid allows businesses to get their invoices paid by investors when in need of immediate cash

Rare Birds founder Jo Burston wants women to think and ask big

Ernst & Young announces multi-year sponsorship of Tank Stream Labs

Sydney startup Careseekers connects seniors with in-home aged care providers

Sydney startup LegalVision has just closed a $1.2 million Series A round of funding

New startup hub Stone and Chalk wants to make Sydney Asia’s FinTech leader

Image: The Australian. Original Source: The Courier Mail

Startup Dogsperts wants to cash in on the internet’s love for dogs

Danil Krashakov, Founder of Dogsperts[/caption]

He believes that changing a dog’s behaviour is not so much about educating the dog but educating its owner, and it’s this concept that led to Dogsperts.

While Krashakov acknowledges the fact that there are hundreds of pet advice forums and communities online, he said that they’re too time consuming for dog owners to trawl through looking for the right advice. With live video, Dogsperts allows for owners to get personalised advice.

The pet professionals were brought on board after being contacted by Dogsperts directly, while the startup will be looking to leverage the internet’s love for pets and attract users primarily through social media.

“Because people have very strong emotional attachments to their dogs, it is much easier for us to have free, or relatively inexpensive, and engaging publicity in social media. We are one of those folks who ‘enrich’ or ‘pollute’ - depending on which camp you are in - Facebook and other social media with photos of dogs and cute puppies,” Krashakov said.

Payments for video sessions can be made on a per-minute or per-session basis, with prices set by the dog professionals. Dogsperts will be taking a portion of the total cost of each session.

There are surely some people who will look at Dogsperts and scoff at the idea of spending money on things like dog psychologists or dog stylists, but it is undoubtedly a clever concept. As Krashakov said, some people love their pets better than they like other humans, and won’t blink an eye on spending outrageous amounts of money on their dog. People are already spending hours online talking about their pets and trying to find advice for their pets, so why not create a service to speed up that process and monetise it?

While it can be useful for any dog owner, Krashakov suggested that the platform may be particularly useful for first time dog owners and those living in smaller inner-city houses or apartments, whose dogs may have behavioural issues stemming from the small living quarters.

Though it’s still early days for the platform, which is launching this month, Krashakov envisions Dogsperts becoming an online dog park of sorts.

“We want it to not only be live video, but also a community for dog owners who can communicate with each other and befriend each other,” he said.

Danil Krashakov, Founder of Dogsperts[/caption]

He believes that changing a dog’s behaviour is not so much about educating the dog but educating its owner, and it’s this concept that led to Dogsperts.

While Krashakov acknowledges the fact that there are hundreds of pet advice forums and communities online, he said that they’re too time consuming for dog owners to trawl through looking for the right advice. With live video, Dogsperts allows for owners to get personalised advice.

The pet professionals were brought on board after being contacted by Dogsperts directly, while the startup will be looking to leverage the internet’s love for pets and attract users primarily through social media.

“Because people have very strong emotional attachments to their dogs, it is much easier for us to have free, or relatively inexpensive, and engaging publicity in social media. We are one of those folks who ‘enrich’ or ‘pollute’ - depending on which camp you are in - Facebook and other social media with photos of dogs and cute puppies,” Krashakov said.

Payments for video sessions can be made on a per-minute or per-session basis, with prices set by the dog professionals. Dogsperts will be taking a portion of the total cost of each session.

There are surely some people who will look at Dogsperts and scoff at the idea of spending money on things like dog psychologists or dog stylists, but it is undoubtedly a clever concept. As Krashakov said, some people love their pets better than they like other humans, and won’t blink an eye on spending outrageous amounts of money on their dog. People are already spending hours online talking about their pets and trying to find advice for their pets, so why not create a service to speed up that process and monetise it?

While it can be useful for any dog owner, Krashakov suggested that the platform may be particularly useful for first time dog owners and those living in smaller inner-city houses or apartments, whose dogs may have behavioural issues stemming from the small living quarters.

Though it’s still early days for the platform, which is launching this month, Krashakov envisions Dogsperts becoming an online dog park of sorts.

“We want it to not only be live video, but also a community for dog owners who can communicate with each other and befriend each other,” he said.

Can FanFuel secure a portion of the $151 billion social media advertising space?

Startup Daily has formally partnered with Muru-D over the next 12 months to bring you the stories of its startups, mentors and investors.